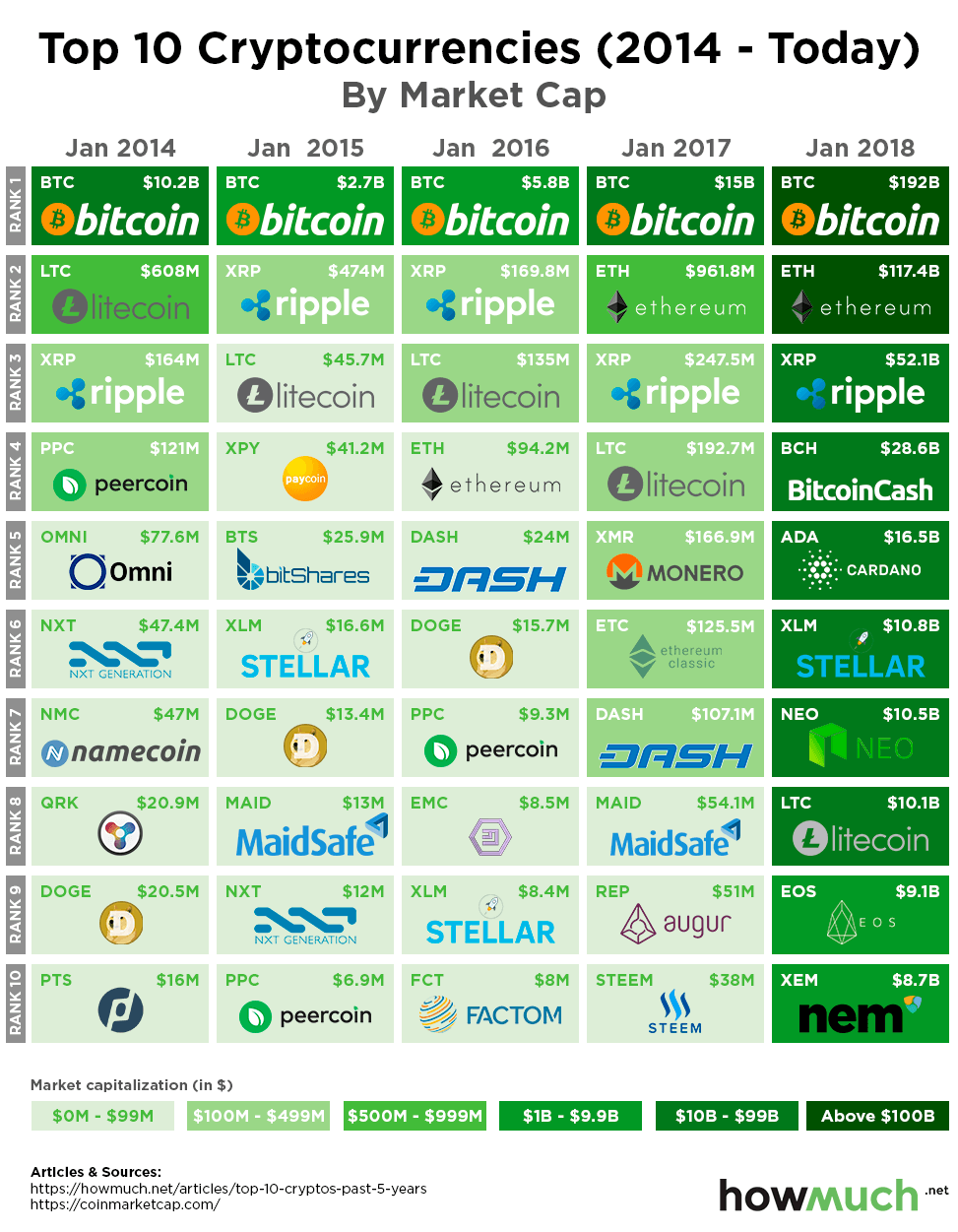

Top cryptocurrency

The miner that provides the correct solution to the problem first gets to add the new block of transactions to the blockchain and receives a reward in return for their work. https://gutsoon.com/ Bitcoin miners are rewarded with BTC, Ethereum miners are rewarded with ETH, and so forth.

Congestion on the largest smart contract-enabled blockchain sent users in search of more scalable blockchains, spurring the growth of alternative layer 1 blockchains and scaling tools. The year brought astronomical gains for the likes of Avalance, Fantom, Polygon and Terra, which ate up half the slots in the top 10.

The world of digital currencies is vast and ever-changing. The most popular cryptocurrency currently is the one that started it all, the pioneer of digital currencies. It was the first to implement blockchain technology and has since remained at the forefront of the market. However, popularity can be fleeting in this fast-paced industry, and it’s important to keep an eye on emerging trends and technologies.

Competing metaverse Decentraland was this year’s number seven performer, after its MANA token soared nearly 40-fold. The entry of institutional players was a large contributor to gains for both SAND and MANA. This past quarter, retail giants such as Adidas and Under Armour announced partnerships with The Sandbox and Decentraland, respectively.

China cryptocurrency

Recent regulatory advances, including the release of the Markets in Crypto-Assets (MiCA) provisional agreement in the EU and the release of the Framework for International Engagement on Digital Assets in the US, signal a desire to provide regulatory clarity in this space. In the future, the adoption of cryptocurrencies and stablecoins will most likely be correlated with the level and quality of regulation in a given jurisdiction. As regulatory certainty influences economic behaviour, large economic regions like the EU and the US are making strides to provide initial direction.

The world first moved to paper money from gold and silver more than 1,000 years ago during China’s Song Dynasty. The next revolution – from paper money to digital currency – could happen in China as well, realizing the nation’s critical goals but with complex implications for global trade and economic order.

At the end of June 2022, the Council presidency and the European Parliament reached a provisional agreement on the markets in crypto assets (MiCA) proposal which covers issuers of unbacked crypto assets, and stablecoins, as well as the trading venues and wallets where crypto assets are held. This regulatory framework is intended to protect investors and preserve financial stability while allowing innovation and fostering the attractiveness of the crypto asset sector. The purpose of MiCA is to provide more clarity across the European Union, as some member states already have varying national legislation for crypto assets, but there had been no specific regulatory framework at an EU level.

Recent regulatory advances, including the release of the Markets in Crypto-Assets (MiCA) provisional agreement in the EU and the release of the Framework for International Engagement on Digital Assets in the US, signal a desire to provide regulatory clarity in this space. In the future, the adoption of cryptocurrencies and stablecoins will most likely be correlated with the level and quality of regulation in a given jurisdiction. As regulatory certainty influences economic behaviour, large economic regions like the EU and the US are making strides to provide initial direction.

The world first moved to paper money from gold and silver more than 1,000 years ago during China’s Song Dynasty. The next revolution – from paper money to digital currency – could happen in China as well, realizing the nation’s critical goals but with complex implications for global trade and economic order.

What is cryptocurrency mining

As a pool miner, you allow the pool to add your mining rig to its existing network, increasing its computing power. The pool then sets up a proportional reward system based on the computing power each miner contributes. As the pool mines blocks, you receive your proportional reward. The payout is generally far lower than solo mining, but the chances of mining a block as a pool are far higher than a solo miner. This makes it a more stable and predictable model.

After hashing each transaction, miners organize them into pairs and hash them again to form a ‘Merkle Tree’ or ‘hash tree’. They repeat this process until they produce a single hash representing all previous hashes, also known as the ‘root hash’.

The mining process is what you may have heard called proof-of-work (PoW)—the work done to generate the winning hash is viewed as proof the miner validated the transactions in the block, so it’s called proof-of-work.

The screenshot below, taken from the site Blockchain.info, might help you put all this information together at a glance. You are looking at a summary of everything that happened when block No. 490163 was mined.

English

English  Français

Français  Nederlands

Nederlands  Italiano

Italiano  Español

Español  Português

Português  Română

Română  Polski

Polski  عربي

عربي